By: GreatAmerica on November 6th, 2023

Finishing the Year Strong - What You Need to Do Now to Prepare for a Successful New Year in 2024

Lee Rozeboom, Vice President and Managing Director of Sales at GreatAmerica, and Peter Kujawa, Vice President and General Manager of Service Leadership, Inc.®, a ConnectWise solution hosted the third and final of a 2023 series of webinars discussing best practices for technology service providers (TSPs) and specifically what to do in Q4 to prepare for a successful new year.

Watch the recorded version of this webinar below.

Finish the Year Strong - Top Three Things You Need to Do Now to Prepare for a Successful 2024

Read through this blog for a summary of the webinar above which focuses on the ways Best-In-Class TSPs are spending their time in Q4 to prepare for the new year.

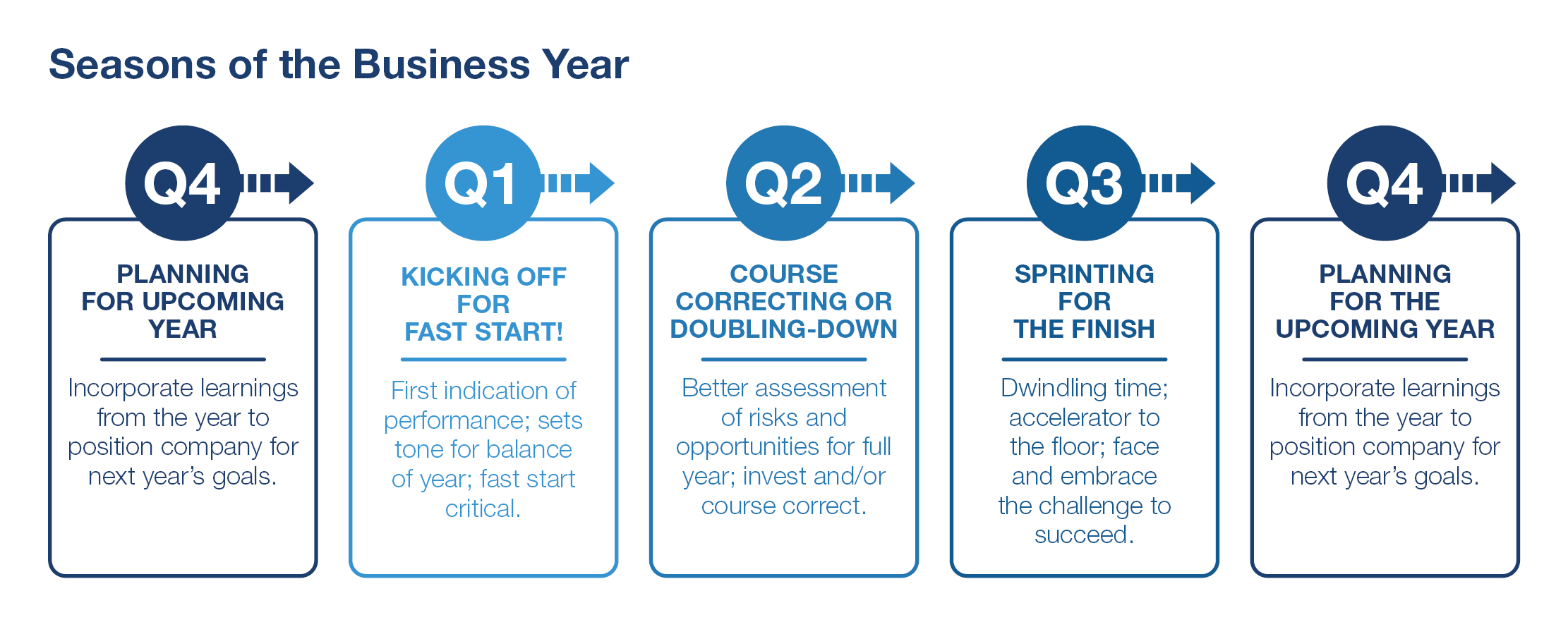

Before we focus on how to plan for the upcoming year, let’s review the seasons of the business year:

Q4 is the time to plan for the upcoming year, so you are ready to go as soon as Q1 starts. You don’t want to start your planning in Q1 and kick off the year late January or early/mid-February because you will lose Q1 if you do.

While Peter emphasized that little can be done at this late stage of the year to affect full financial results (compared to earlier in the year), he urged the need to keep your foot on the gas. For example, if your company is behind, every deal matters for your profitability for the year. Get whatever you can closed, get your onboarding done, and your projects completed to the greatest degree and with urgency as much as possible. If you’re fortunate enough to be ahead, this is your opportunity to pour it on and carry that momentum into the new year. The theme was clear – continue to get your deals in regardless of how your year is going.

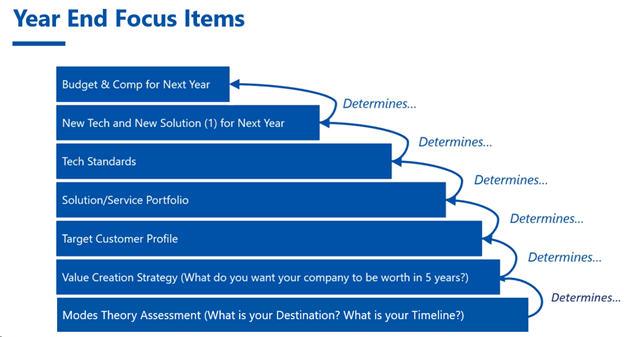

Now let’s take a deep dive into the following year-end items (shown below) to focus on, and how GreatAmerica can help our customers achieve greater success.

This is a bottom up exercise with each item affecting the other one.

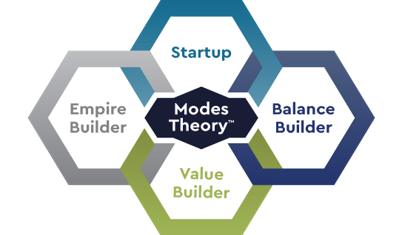

Modes Theory™ Assessment

The first item is Modes Theory developed by Arlin Sorenson of ConnectWise. It starts with answering the following three foundational questions, which leads to four Modes Mindsets. It will help you understand what you’re trying to build, how you’ll get there and how long you have to get to your destination.

- What is your destination? What are you trying to build?

- How will you get there? What does your journey look like?

- When is your timeline? How long do you have?

The Four Modes:

- Startup: You are open to many possibilities for what your company will become.

- Balance Builder: You want success, but you won’t sacrifice your personal life to get it.

- Value Builder: You want to build consistent long-term value and profitability.

- Empire Builder: You want swift growth and will make short-term sacrifices for substantial opportunity.

The key is to understand which Mode you are in as it will impact your business. Visit ConnectWise to take the assessment. Keep in mind that GreatAmerica Financial Services can help your business at each of the four modes.

Value Creation Strategy

Next, look at your value creation strategy. To begin, there are three questions to answer as it relates to a value creation strategy:

- What do you want the company to be worth?

- In what period of time?

- How will you plan to monetize that value?

Peter encouraged attendees to be sure #1 and #2 are understood by your leadership team because that will drive risk taking in the business and budgeting. You also need to make sure you and your leadership team are on the page with the value creation strategy. TSPs who are SLIQ™ subscribers, can use SLIQ valuation creation planning tool from Service Leadership to help with their value creation strategy. This tool helps TSPs who want to drive accelerated performance and maximize the profit potential of their business. This time of year, you should validate if you are keeping your strategy the same or changing it.

Target Customer Profile

Third, look at your target customer profile (TCP). In a previous webinar, Peter discussed the importance of a TCP. The biggest takeaway? Focus on or meet the needs of your niche environment instead of trying to focus on helping every level of your customer base. This doesn’t mean you can never sell larger or smaller, but you shouldn’t try to serve everyone at one time. This time of year is a great time to assess where you’re at and determine if you’re keeping your TCP the same or changing it.

Solution/Service Portfolio

Now it’s time to determine what offering(s) you will introduce, if any, in 2024. You want to see not only where you are today, but also where you are trending.

One of the areas you want to focus on to see where you’re trending is the wallet share, the percentage of managed services contracts sold that are fully managed contracts. For Best-in-Class MSPs, they are up over 70% for their fully managed service contracts through Q2 of 2023.

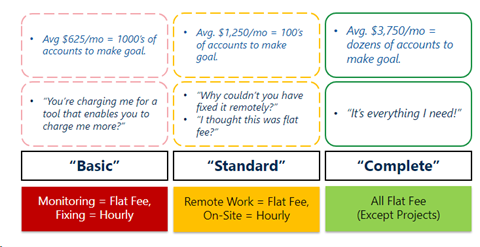

Work to have all your customers on a fully managed contract, or a “Complete” contract. Look at the “Good/Basic”, “Better/Standard” and “Best/Complete” structures below and how they impact your value creation goals:

To move packages from “Basic” and “Standard”, without firing all those non-conforming clients, you can follow an evolutionary process on a transitional basis. Begin by reducing the number of offerings today to only one “Complete” offering. Secondly, move your existing clients to your “Complete” offer over the next 12 months. You can do this at renewals by EOL of their old plan and during Quarterly Business Reviews.

Increase Pricing on a Calendar Basis

While many increase pricing at end of year, the timing of when that happens is not the most important factor. It’s more important that you consistently revisit pricing at least once a calendar year. When you do increase pricing, it’s best to follow these Best-In-Class tips:

- Be sure your multi-year contracts include escalators

- Don’t use an “up to X%” or customers will think they can negotiate

- Fix it today in your existing contracts

- Project labor rates

Remember, Hardware As-A-Service can be used to offset the impact to clients.

RELATED: Grow Your As-A-Service Offering with Hardware as a Rental®

For sales organizations looking for an easy solution to drive incremental improvements, begin or ramp up selling a monthly payment. When attendees were polled in the webinar, 32% said they lead with a monthly payment, with an additional 21% saying they already go all in with an XaaS model. Help your sales team close out the year strongly with monthly recurring revenue. Contact GreatAmerica to learn about end of year promotions for technology financing.

Tech Standards

If a TSP is at a high Operational Maturity Level™ (OML™), they are very profit-driven and focus on a single tech stack.

If you’re not in a position to move to one stack, follow an evolutionary process:

- Stop the bleeding starting today.

- Reduce the number of offerings, we strongly recommend going to one, all-in or “Complete” offering.

- If you have more than two offerings and won’t go to only one, reduce the number you have. Go from three to two, for example.

- Move your existing clients to your “Complete” offering over 12 months.

- At renewals by EOL their old plan (“We no longer offer that service offering, you’d benefit more from this one, let’s discuss why…”).

- During contract, where possible, during Quarterly Business Reviews.

Read more about technology standards as it relates to recruiting and retention in this blog centered around maintaining profitability when it comes to recruiting and retention.

New Tech and New Solution (1) for Next Year

You’re thinking of selling something new, so what are the challenges of adding any new solutions? The bottom line is that there are too many great new solutions (products) and ideas for service offerings than any TSP – of any size – can afford to build marketing, sales and delivery capability factory to sell even a small fraction of them with profitability and quality.

Without profitability and quality, the TSP’s cash flow and reputation disappear, and their company or at least the services business in it – will shortly follow.

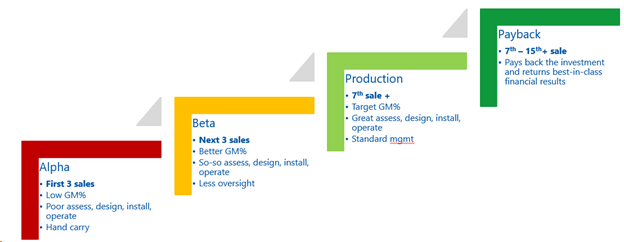

When you finally decide on selling something new, make sure it’s something you can sell 15 times in a year. Why that number? Let’s use the graph below to find what’s behind that number.

- First three sales (Alpha), you are going to struggle. Poor gross margin, your team will be learning, and trying to understand how to install and support it. It will be tougher to install the product.

- Next three sales (Beta) will be a little bit better. Gross margin will be better and it will not be as time-intensive for your team.

- 7+ sale (Production) you will start to deliver at a gross margin that is closer to your target, and your team will start feeling very comfortable with the product.

- After 15 sales (Payback) your team will be extremely comfortable with the product and you will be able to reliably deliver the service gross margin expected on the product.

Remember, it’s fine to introduce a new solution. Use a methodology, like the one above, to make sure you can sell enough to justify it.

Budget and Compensation for Next Year

Now we’ve reached the top of the pyramid. In Q4, this is the time have a full 2024 budget in place by calendar year end. It will help you increase your profitability of success, understand where you’re going and manage risk. The Best-in-Class are extremely good at budgeting. Strategically, “budgeting” means running your business with the stated intention of generating a committed bottom line profit dollar and profit percent.

You might be thinking – what is the difference between budgeting and forecasting? Budgeting answers the question, “what profit are we going to attain next year,” whereas forecasting answers, “how close are we to budget, this month?” Budgets never change once created and provide an aggressive and attainable financial plan for the next fiscal year. Forecasting is performed monthly or weekly during the year and compares projections against the budget.

Businesses with a high OML not only have an established annual budget, but they also measure performance monthly as a percentage of the budget. Additionally, they ensure management incentives are proportional to attainment percentages and are greater than 30% of the total management pay.

There are different ways to build a budget, but the most important factor is that you do in fact build a budget. The webinar featured five different ways to build a budget, however, your aim is to achieve the “AA” Standard; AA means it must be both aggressive and attainable. Being aggressive means your budget maximizes value for the company, demands excellence at all levels, and is a culture that attracts high performers. Having an attainable budget requires a high OML budget. This creates a team belief that the target can be hit, meaning you have a winning and successful culture.

Budgets should also include BMW (Best Case, Most Likely Case, and Worst Case). Best Case is what you should reasonably budget if the best possible outcomes were achieved across all departments. A Most Likely Case should be your aggressive and attainable plan for the next year, which you’ll tie incentive plans to. Lastly, a Worst Case budget accounts for what will happen if the wheels fall off and outlines a plan for the reductions you will need to make.

Keep in mind it’s easier to maintain an objective view of what actions should be taken in advance of a crisis rather than defining those actions in the middle of a crisis.

There you have it, the seven items to focus on now. In case you missed the previous webinar in this series earlier this year, we focused on compensation best practices of the most profitable solution providers. You can watch the webinar recording here and check out the blog summary.

GreatAmerica

GreatAmerica Financial Services® is the largest family-owned national commercial equipment finance company in the United States. With $3.5+ billion in assets and life-to-date finance originations of $16.1 billion, GreatAmerica is dedicated to helping manufacturers, distributors, resellers, and franchisees be more successful and keep their customers for a lifetime. GreatAmerica offers innovative, complementary services in addition to financing. Established in Cedar Rapids, Iowa in 1992, GreatAmerica also maintains offices in Des Moines, IA, Marshall, MN, Milton, GA, and Northbrook, IL. The company is deeply rooted in the communities where it has offices, contributing more than $1.1 million annually through its Donor Advised and Employee Advised Funds—empowering team members to guide charitable giving and make a meaningful difference where they live and work.